Make Daily

Spending Better

A checking account is your constant companion. It should fit your lifestyle like a snug backpack.

Discounts, rewards, ID theft aid, and roadside assistance. $3.95 a month.

| Advantage Checking | Simply Checking | |

|---|---|---|

| No per check charge | ||

| Online & mobile banking | ||

| Free eStatements | ||

| Free debit cards | ||

| Funds insured by the NCUA | ||

| Local business discounts | ||

| Cell phone protection | ||

| Identity theft protection | ||

| Roadside assistance | ||

| $10,000 travel accidental death coverage | ||

| Pharmacy, vision and hearing savings |

Why Elevate?

We don’t have service charges if you drop below a certain balance.

Manage your checking account with direct deposit, bill pay, mobile deposit, mobile banking, and online banking.

Prevent declined transactions with Courtesy Pay and Overdraft Protection.

Mobile Deposit And Online Bill Pay.

Manage your checking account through a variety of online tools. Snap a picture of a check to get it into your account and pay bills without ever licking another envelope.

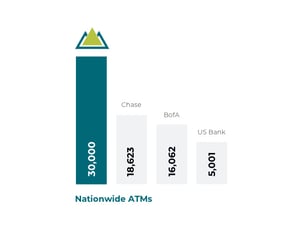

More Fee-Free ATMs Than The Big Banks.

Get cash when you need it with a CO-OP ATM network that’s 30,000 strong.

A Powerful Debit Card.

A free debit card with remote card controls. We can print it for you instantly at any branch. Once you’ve got it, feel extra safe knowing you can review all your transactions, turn your card off and on, and set up custom alerts with online and mobile banking.

Rewards And Discounts.

Advantage Checking comes with access to BaZing rewards. You’ll get special local and online deals, health savings, travel savings, and more.

HOW DO I APPLY?

If you are already a member, to open a checking just give us a call or visit any of our Elevate Branches and speak with an Account Specialist and we will get you taken care of.

If you aren't a member yet, you can apply online, or in a branch. If you have questions, text us at (435) 723.3437.

Frequently Asked Questions

If you don't see your question here, text us at (435) 734.3437. We are happy to help!- Towing

- Battery service

- Flat tire assistance

- Fuel

- Oil, fluid, and water delivery service

- Lock-out assistance

- Collision assistance

- Extrication assistance

Members age 55+ can receive up to 10 sheets (40 checks) free at a time. Checks may be picked up at any branch or mailed directly to the address on file. A complimentary check register will be included with each printing.

Overdraft LOC

Overdraft Line of Credit is a service we offer to help members prevent declined payments. With an Overdraft Line of Credit, you get a line of credit attached to your checking account that covers payments that exceed your account balance.

Ask Simon, our AI bot a question 24/7 by clicking the "Live Chat" button in the lower right corner, or speak with one of our Elevate Team anytime during our business hours by doing the same. Or, fill out this brief form and we will get back with you. We are here to help and answer your questions!